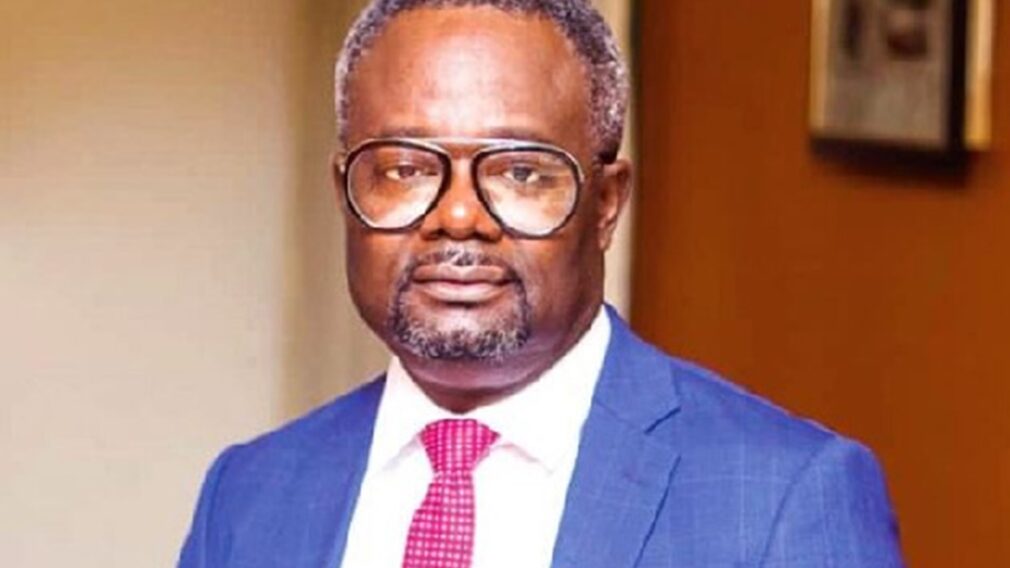

Kofi Akpaloo Calls for Increased Taxes on Sports Betting in Ghana

Kofi Akpaloo, presidential candidate in Ghana, has called for higher taxes on sports betting to discourage youth participation in gambling. He argues that rather than scrapping the existing betting tax, stronger measures are needed to curb the negative impact of betting on society.

Akpaloo Opposes Betting Tax Abolition, Proposes Higher Levies Instead

Presidential hopeful Kofi Akpaloo has stirred discussion in Ghana by proposing an increase in taxes on sports betting. Unlike his political opponents, who are pledging to abolish these taxes, Akpaloo believes that higher taxes could serve as a deterrent, especially for the youth. He regards betting as a harmful activity and insists that stronger measures are necessary to reduce its appeal among younger generations.

Since January, the Ghana Revenue Authority has enforced a 10% withholding tax on all lottery and sports betting gross winnings. Despite this policy, both major political parties, the ruling New Patriotic Party (NPP) and the opposition National Democratic Congress (NDC), have made election promises to scrap the betting tax. Notably, NDC presidential candidate John Mahama and the NPP’s Dr. Mahamudu Bawumia have both vowed to remove the tax if elected.

Akpaloo Criticizes Opposition Candidates

Akpaloo, leader of the Liberal Progressive Party (LPG), has openly criticized these promises, suggesting that both Mahama and Bawumia are not genuinely addressing youth employment.

He accused them of using the tax abolition as a tactic to gain votes, stating, “It’s a big lie for somebody to tell you that he’s going to create jobs and then promise the young people that he’s going to take away betting taxes because you want to encourage them to do more betting.”

Despite Akpaloo’s stance, sports betting has become a growing industry in Ghana, attracting both young participants and numerous betting companies. Over the past decade, the sector has expanded rapidly, raising concerns about its influence on society and the economy.

Recommended